Are You Sure You Know the Difference when Classifying Someone as your Employee vs. an Independent Contractor?

Ms. Pomerantz is the CEO of TPG HR Services USA and has over 35 years of Human Resources practices experience. She holds a Master’s in Human Resource Management (MHRM) and is a certified Senior Professional in Human Resources (SPHR) and SHRM Senior Certified Professional (SHRM-SCP). Mary also serves as CEO of Mary Pomerantz Advertising, one of the largest recruitment advertising agencies in the country. Earlier in her career, she was president of the 17th largest staffing firm in the country.

Making a worker classification mistake when trying to determine if someone is an employee or a contractor can sometimes be both costly and time-consuming. At worst, it can result in expensive and resource-draining lawsuits or enforcement actions from the IRS and/or other government entities, and at best it may only impact staff morale and productivity. Unfortunately, it is not always easy to determine a worker’s correct classification status when filling out an IRS Form SS-8. If you are a business owner facing this dilemma, hopefully, the following discussion can make your worker classification issues a little bit clearer each time you fill out the mandatory worker classification form for each employee.

The worker classification guidelines the IRS provides to the public are somewhat nebulous and why many employers are confused about what they need to do.

According to the IRS,

“It is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors. Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors.”

[1] irs.gov

However, if you want to seek the help of the IRS in determining whether a worker is an employee or a contractor, be prepared to wait – a long time. Although they have a specific form to submit for this purpose (Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding), you should be aware that, in their own words, “it can take at least six months to get a determination.” [1]

The guidelines the IRS gives to the public on this subject are somewhat nebulous. According to the IRS, “In determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered.” They state that businesses must weigh all of these factors, looking at the entire relationship, considering the degree of the right to direct and control, and documenting each of the factors you used to come to your decision for worker classification. [1]

States classify employees and/or independent contractors differently

Further complicating the process of classifying individuals as employees or independent contractors, different states (and parts of the federal government) use different criteria to define who is an employee and who is an independent contractor. As an employer, it is your responsibility to be aware of every evaluation criteria for worker classification. If you have employees and independent contractors working in more than one state, this can quickly become a complicated process, as one state’s employee might be another state’s independent contractor.

So, how does one begin to understand this complicated system of conflicting worker classification systems? Fortunately, most states and federal entities use one of two main “tests” to classify employees and independent contractors: the Common Law test and the ABC test. The remaining states use partial versions of the ABC test, corresponding to combinations of the A, B, or C portions of the ABC test.[2]

| Common Law Test | ABC Test | A&C of the ABC Test | A&B or A&C of the ABC Test |

|---|---|---|---|

| Alabama Arizona District of Columbia Florida Iowa Kentucky Michigan Minnesota Mississippi Missouri New York North Carolina North Dakota South Carolina South Dakota Texas | Alaska Arkansas California Connecticut Delaware Georgia Hawaii Illinois Indiana Kansas Louisiana Maine Maryland Massachusetts Nebraska Nevada New Hampshire New Jersey New Mexico Ohio Oregon Puerto Rico Rhode Island Tennessee Utah Vermont Washington West Virginia | Colorado Idaho Montana Pennsylvania Wisconsin Wyoming | Oklahoma Virginia |

Note: 2 important entities in the Federal government actually use different tests to determine worker classification: the Internal Revenue Service uses the Common Law test while the Department of Labor uses the ABC test. [2]

Employee or Contractor?

2 Tests to Determine Worker Classification Status

Common Law Test

The worker is classified as a contractor unless the employer has:

- Behavioral Control

- Financial Control

- Relationship Control

ABC Test

The worker is classified as an employee unless the worker has:

- An Absence of Control

- Performs “Unusual” or Off-Premises Work

- Has an Independent Business Identity

How the Common Law test classifies employees/contractors

The Common Law test begins with the presumption that the worker is a contractor unless the employer wields ANY of 3 specific controls over the worker. The 3 specific controls for the Common Law test: Behavioral Control, Financial Control, or Relationship Control. First, Behavioral Control is the measure to which an employer directs workers on how they perform the tasks assigned to them. This can be control over how the work is done, where the work is done, or the schedule of when duties will be performed. If an employer controls any of these parameters the worker is considered an employee.

Second, Financial Control refers to financial issues such as employers providing facilities or equipment or reimbursing expenses. Also considered are issues such as whether the worker can experience either a profit or a loss (contractor status) or whether the workers offer the same services on the open market (or just for the employer). Third, Relationship Control examines the relationship of the parties as to if a company provides benefits to workers, defines terms of employment, or if the worker’s business is part or not part of the usual course of business for the employer. For example, a plumber working for a plumbing company is probably an employee whereas a plumber working for a restaurant is probably an independent contractor. [2]

How the ABC test classifies employees/contractors

Unlike the Common Law test, the ABC test begins with the assumption that a worker is an employee unless they meet the three criteria (A, B, C) of the ABC test. These criteria are whether the worker (A) has an absence of control over how they perform their work, (B) performs work off-premises or of an unusual nature from that typically performed by the employer, and (C) has an independent business identity from the employer. An Absence of Control is demonstrated when a worker is free from the direction of the employer in how they complete their work, outside of minor exceptions such as business hours limiting access to a facility.

“Unusual” work is work that is unusual relative to the “normal” work performed at a given company. Examples could include plumbers or painters hired to maintain or improve a company’s office space. In addition, work performed off-premises can qualify under this category, unless that is the usual form of work performed for the company in question. Workers with an independent business identity typically work on a “per job” basis and can also be identified by the fact that they perform the same service for other companies on the open market. [2]

The Importance of Getting it Right

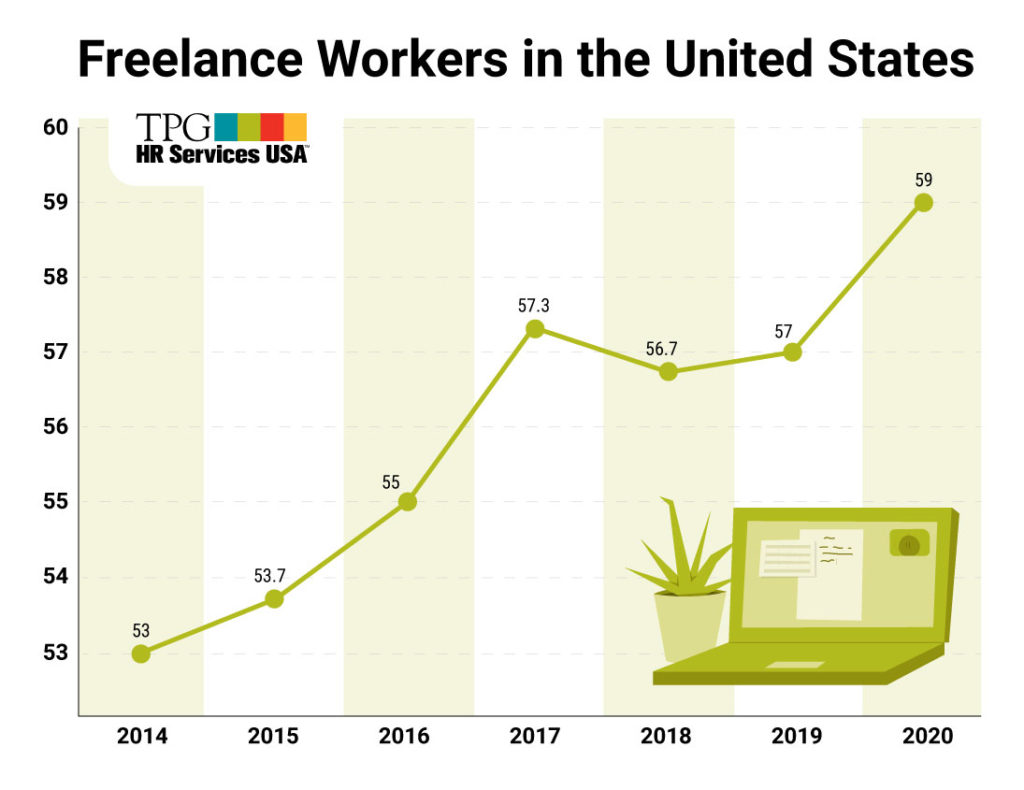

Now, more than ever, it is important for employers to get it right when it comes to classifying individuals as employees or independent contractors. The number of legitimately classified “freelancers” keeps growing in the workforce, but numerous court cases and high-profile enforcement actions have led to higher than ever scrutiny on the worker classification process. You don’t want your company to fall under the magnifying glass of Federal or State regulators or the courts due to a mistake in classifying the individuals who fuel your company’s success. According to LE Global, a worldwide alliance of employers’ counsels, “Enforcement efforts by government agencies have been stepped up markedly in recent years, while private collective and class action lawsuits abound. Any independent contractor relationship should be carefully reviewed and managed to avoid the potentially serious consequences of an adverse agency ruling or court judgment.” Now is not the time to get on the wrong side of the classification issue.[4]

Where to Go for Help

Unfortunately, you can’t expect the IRS or other government agencies to offer to help you proactively in making these critical determinations. However, that doesn’t mean there aren’t experts in this area who can assist you in making these important worker classification determinations. For many companies, turning to an HR services company like TPG HR Services is the best way to navigate the often-confusing world of intersecting Federal and State regulations around employee/independent contractor classification. By partnering with the HR experts at TPG HR Services, you can be confident that your workforce, both employees and independent contractors, have the correct worker classification, helping you to avoid the often costly and time-consuming legal and regulatory battles that misclassification can bring to your company’s doorstep.

Sources:

- https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee

- https://www.nelp.org/wp-content/uploads/Policy-Brief-Independent-Contractor-vs-Employee.pdf

- https://www.statista.com/statistics/685468/amount-of-people-freelancing-us/

- https://knowledge.leglobal.org/eic/country/united-states-of-america/legal-framework-differentiating-employees-independent-contractors-22/