Are You Sure You Know the Difference when Classifying Someone as your Employee vs. an Independent Contractor?

Making a worker classification mistake when trying to determine if someone is an employee or a contractor can sometimes be both costly and time-consuming. At worst, it can result in expensive and resource-draining lawsuits or enforcement actions from the IRS and/or other government entities, and at best it may only impact staff morale and productivity.…

Read MoreHow to do successful Virtual Employee Onboarding during COVID-19

Successful virtual employee onboarding has become the most crucial part of the hiring process during the COVID-19 pandemic. Virtual employee onboarding has become a requirement for organizations that now rely on a partially or completely remote workforce. However, the challenges of the COVID-19 pandemic era have revealed that many companies are ill-prepared to conduct virtual…

Read MoreWhy Should Businesses Choose Payroll Outsourcing?

The importance of correctly managing employee payrolling, combined with the sheer complexity of state and federal regulations, has led many business owners and CEOs to choose payroll outsourcing. The reasons for payroll outsourcing usually vary depending on the company and workforce size. For many smaller businesses, the lack of resources to hire the necessary qualified and…

Read MoreWorking in a COVID-19 World: The New Normal

COVID-19 has created a new normal for how we work. You might be working from a new home office setup or you may have gone back to work at your company office that now has some form of dividers and/or physical distance separation. In either new COVID-19 workplace scenario there are issues and concerns that…

Read MoreHR Outsourcing Can Be Your Best Defense Against the Onslaught of New Government Regulations

HR outsourcing, also known as HRO, can be a tremendous asset to many companies, enabling them to improve the “user experience” of their employees when they access Human Resources functions, enhance the quality and range of the employee payroll and benefits experience, and ensure the company’s compliance with critical workplace laws and regulations. For business owners, these positive features often come with…

Read MoreOvercome workforce challenges in a COVID World by Outsourcing HR Services for your Small Business

There may never be a better time than today to consider outsourcing HR Services for your small business as it emerges from COVID-related restrictions. To overcome all of the new rapidly changing workplace challenges, outsourcing HR services for your small business helps your company to survive and grow in the future. The following 10 tips from…

Read MoreEmployee Payrolling Services Offered by 3rd party HR Services Provider

When it comes to your company’s workforce there are many options and strategies from which to choose. These range from traditional in-house recruitment for permanent staffing to more flexible options such as temporary hiring or contract staffing. Another popular HR strategy many companies choose is employee payrolling through a third-party HR services company. If you’re…

Read MoreWorkforce Challenges & Opportunities during the COVID-19 Pandemic

The COVID-19 pandemic has presented employers and HR professionals with significant workforce challenges (and some opportunities) that need to be reckoned with and considered. For example, under the pressures of the COVID-19 pandemic, many business owners have turned to work-from-home staffing strategies to keep their employees safe and their companies running. For many companies, this…

Read MoreSexual Harassment Lawsuits in High-Risk Workplaces

Since the rise of the #MeToo movement, the number of sexual harassment lawsuits in the workplace has increased dramatically in the U.S. and around the world. Proactive companies have wisely reevaluated their sexual harassment policies and training or in some cases implemented them for the very first time, or in a very long time. The…

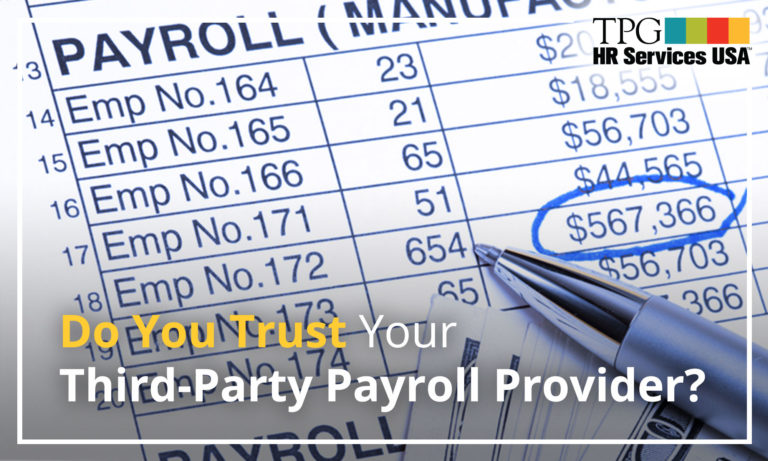

Read MoreDo You Trust Your Third-Party Payroll Provider?

First, do you even need a third-party payroll provider? The answer is yes because it is a very difficult task for businesses to stay compliant while maintaining accuracy with their; business payroll, employment tax withholding, tax return preparations, as well as their reporting and tax payment responsibilities. There is a vast multitude of laws and…

Read More